Despite the volatility of the world economy, fintech-related startups remain an appealing target for investors. It’s likely that you’re a professional in the area of finance and are now deciding to get involved in the fintech revolution. AI is the next frontier in technology. Therefore, several industries are interested in it and seeking success within the highly competitive marketplace. AI has a bright potential in the financial and banking sectors. One example of an AI application in the field is an AI-powered banking and financial solution calculator app development.

The AI calculator app uses AI’s potential to aid users in various financial and banking calculations. It uses AI algorithms and machine-learning methods to give users high-quality and precise information that helps them make better decisions. The value generated annually by AI and analytics to worldwide banking could reach $1 trillion. Over 60% of financial institutions have decided to use AI-based fintech solutions for their daily business, leading to numerous new businesses looking to create an AI calculator application.

You’re at the right spot if you are searching for an app similar to this one. This article discusses all the aspects needed for finance and banking calculator app development.

Let’s get started.

Rise Of AI Within Banking

In the past, traditional financial service companies have needed help innovating. Large banks were 40%less productive than digital natives. Numerous emerging startups in banking are introducing artificial intelligence-based use scenarios, making it crucial that traditional banks get on board and start to innovate.

Companies that deal in investment banking have long utilized natural language processing (NLP) to analyze the huge amounts of information they collect internally or obtain from third-party sources. They employ NLP to study the data to make more well-informed decisions regarding investment and managing wealth.

The financial sector, in particular, has been absorbing the advantages of AI technology. Customers want better digital banking experiences with apps that let them get more details about services, talk to people or virtual assistants, and manage their money. Businesses must improve their customer experience to keep clients satisfied. Implementing and using AI strategies is a way to do this.

Although AI can be powerful, pairing it with automation can unlock more possibilities. Automated by AI, it combines the wisdom of AI and combines it with the reliability of automation. For example, AI development can enhance robotic process automation (RPA) to interpret data analytics more efficiently and perform actions according to what the AI determines to be the best.

Importance Of AI In Banking Calculator App Development

AI makes the finance sector more sophisticated, resulting in better performances and more effective results for users. Regarding the security of online transactions, investing choices are made through AI within the finance sector, which eases multiple processes. Consider the compelling reasons why AI and fintech software development solutions are crucial to the financial industry.

Improving The Customer Experience

They are usually open at any time, whether it’s a holiday or even a weekend. Their operations are different from those of other industries, which exhausts employees. AI, in this instance, has a significant role in providing chatbots and rapid responses to clients, leading to employees working more efficiently.

Operational Cost And Risk Reduction

While the business is continually moving towards digitalization, various banking methods are paper-based, leading to increased operating expenses and a higher risk of failure due to human errors. Therefore, AI within the banking industry includes a variety of technologies that could lead to increased efficiency and less expense.

Improved Fraud Detection And Regulatory Compliance

Banks are among the most closely regulated areas of the global economy. Numerous laws must be observed to secure vast data and prevent data breaches. This is why AI is a key element, observing all transactions and analysing fraudulent activities and risks based on data and transactions, making it safer.

Improved Loan And Credit Decision-Making

AI will make banks more profitable, knowledgeable, and secure for loans and credit-related decisions and help us all step. It can also help overcome the lengthy process of utilizing histories, credit scores, customer reference numbers, several mistakes, the absence of historical transaction data from real life, and incorrectly classifying creditors. AI’s participation can enhance all the processes and determine if a customer is a credit-worthy person or could be more likely to default.

Do you want to transform the way you run a financial business with our FULL-SCALE AI APP DEVELOPMENT SERVICES?

Pooja Upadhyay

Director Of People Operations & Client Relations

Who Can Use AI-Powered Calculators?

AI-powered calculators are an excellent option that benefits various people, such as companies, people, and finance professionals. We’ll examine how everyone could benefit from these calculators during their day-to-day tasks. People can use AI-powered banking calculators to create and manage personal budgets. The tool will analyze your spending patterns, create savings objectives, and give insight into finances such as interest rates, mortgage payments, and cash flows.

Concerning businesses, there are a variety of scenarios for companies to use according to the requirements of entrepreneurs and small-scale businesses. They can use calculators for budgeting, estimating revenues, and estimating expenses. It is also possible to evaluate the effect of different finance methods on their financial results. Companies can utilize these calculators when seeking loans or mortgages to estimate the repayment timetable, economic feasibility, and interest rate.

Financial institutions can integrate AI-powered calculators into their applications to increase customer interaction. Customers can use the calculator to perform various financial calculations, improving interactions with the platform. The calculators can also assist with making financial products more personalized, like loans and investment plans, according to the client’s demands and requirements.

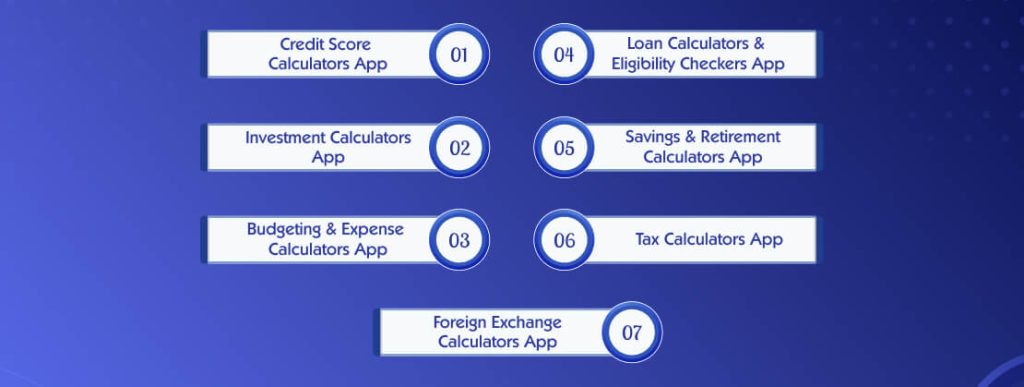

Types Of AI-Based Financial And Banking Calculator Apps

In this section, we will look at the different types of AI-powered apps used by banking and other financial institutions.

Credit Score Calculators App

These apps aid the user and firms assess a person’s credit scores. This is helpful when the loan is approved. Someone with a great credit score can get loans, and financial institutions also have more information about providing loans to individuals. AI can improve a credit profile by using available information sources to create a much more thorough and dynamic profile of individuals.

Investment Calculators App

Calculators like these assist you in planning investments, beginning with SIP and stock investing, to meet your future objectives. Using AI, users can estimate the potential returns on the investment using one of these calculators. You can also analyze the percentage of your increasing investment and what it will be over time.

Budgeting And Expense Calculators App

They are apps that manage your finances and help you plan your monthly budget. Through AI, the app tracks each expenditure and makes a perfect option for budgeting. Various budgeting and expense calculation tools are available on the market that you can download.

Loan Calculators And Eligibility Checkers App

Calculators in this category include a variety of functions, such as mini banks. They assist the user in determining their loan eligibility and estimate the amount they are eligible for at an exact period and undertaking. The calculators speed up the process and are simpler for banks and users, with no lengthy process.

Savings And Retirement Calculators App

These calculators have been designed to assist businesses and users who want to estimate expenditures and prepare for retirement. Using AI technology, the calculator creates an appropriate plan sheet to determine the amount to be saved or spent, and based on this, all expenses can be scheduled.

Tax Calculators App

This calculator assures users they pay attention to the most important tax-related information. Suppose you want to know all the details of the essential tax and tax obligations. In that case, it is necessary to utilize a reliable calculation of income taxes. It helps make the process simpler and more precise and correct tax calculation. It can detect possible errors when calculating taxes and reduce penalties using AI’s help.

Foreign Exchange Calculators App

Calculators help transform the worth of a currency into an alternative one. They’re ideal for people who travel and help you plan your budget and expenditures. They provide the equivalent value of one currency to another based on a range of defined mid-points.

Additionally, it allows users to determine how to convert foreign exchange rates among various currencies. Suppose you are a business that operates overseas. In that case, these calculators can be beneficial because they offer AI-powered solutions, such as current rates for foreign exchange and predictions.

Features Of AI-Powered Banking And Finance Calculator App Development

Financial calculators can be all-in-one models or customized to meet different people’s needs. According to the information we’ve provided in the section above, different types of calculators can be distinguished. However, what is common to all banks and financial calculators is the functions offered when providing apps. Let’s look at the most essential features that firms should look to use.

Login/Sign up

The most crucial and first component of every application is the login or sign-up button. It allows new users to sign up and access the calculator’s various features, allowing existing users to log in anytime they wish to use the application.

Multi-Factor Authentication

The security feature allows users to access accounts or systems by using security factors. This feature is also known as two-factor verification. By utilizing AI integration within the profile, verification will automatically be detected when the user has signed into the app.

Voice Activation

Users can interact with the calculator using spoken commands, increasing its accessibility and facilitating its use. This unique feature allows hands-free operation, allowing users to do calculations and get financial information quickly.

Adaptive Design

A flexible design guarantees a smooth user experience across screens and gadgets of different sizes. The user interface adapts dynamically for optimal useability using a desktop, tablet, or mobile phone.

Integration Of Other Financial Tools

The calculator seamlessly connects to many financial instruments and apps, easing the transfer of data and offering an extensive overview of economic data. The interoperability allows users to effectively manage and consolidate the financial details.

Automated Investing & Savings

The calculator can be used to create automated savings and investment plans. This function allows the user to schedule transfers, investments, and contributions to ensure an organized approach to building the wealth of your family over long periods of time.

Multilingual Support

It can also provide multilingual support to expand the user base and increase the number of users. The user can select their preference of language as its interface, making the calculator accessible and user-friendly to people from different linguistic backgrounds.

AI-Based Predictive Analytics

Using artificial intelligence, this calculator can provide predictive analytics that helps users make better financial choices. Analyzing data from the past and patterns can offer information about possible scenarios for the future, which can aid in the strategic planning process.

Chatbots & Virtual Assistants

This calculator utilizes chatbots and virtual assistants to provide personal and interactive assistance. Users can participate in natural-language conversations and get immediate assistance, explanations, and guidance regarding financial questions.

Steps for AI-Powered Financial and Banking App Development

Following certain steps for finance and banking calculator app development. is vital. Below is a quick overview of these steps to provide a brief review.

Define Objectives And Scope

The first process is to determine the exact financial or banking calculation that you would like to improve using AI. We must also identify the elements that require upgrading and improving through the use of AI inside the application, such as providing recommendations based on your preferences and improving accuracy and automated calculations for complex tasks.

Data Collection And Analysis

Take all pertinent data relevant to the needs of the financial calculator. These include historical information, market trends, information about users (if appropriate), and any regulatory information. Study the data to discover patterns and patterns that can help build an AI model.

Choose The Right AI Technology

Choose the kind of AI technology with the expertise of your fintech software development that best meets your needs. This could include machine learning, natural language processing, or predictive analytics. Consider built-in AI systems or platforms depending on their requirements to accelerate growth.

Model Development And Training

Create AI models, which involve creating algorithms for assessing risk, customer behavior modelling, predictive analysis, etc. Develop the model with the information you have collected, making sure it can handle the particular scenario and calculations pertinent to your particular banking and financial environment.

Integration Into Existing Systems

At this stage, incorporate the AI model into your current bank and financial calculators. This could mean API integration, re-updating existing software, or creating new interfaces. Ensure that the integration allows seamless data flow and user interaction.

Testing And Validation

Testing is among the crucial aspects of the process since it can identify flaws and issues in the connected system and fix them after the integration can be done. Also, the computers with AI enhancements should be tested thoroughly to ensure accuracy, reliability, and performance. Test the results against established benchmarks and industry norms.

User Interface And Experience Design

Every app must have a user interface and application design to reach the correct target audience. Create a user-friendly interface that makes complex AI calculations easy to comprehend and understand. You might consider incorporating interactive elements, illustrations, and other features to enhance the user experience.

Deployment And Monitoring

The last step is to deploy and monitor the application after the entire process and procedures are complete. Thus, install the AI-enhanced calculators within controlled conditions initially to monitor performance and collect user feedback. Continuously monitor the system for anomalies or issues and ensure it functions exactly as expected.

Ongoing Maintenance And Updates

Update your AI models regularly with fresh information to ensure precision and relevance. Stay up-to-date with the latest financial regulations and market trends for continuous conformity and efficiency. Regularly updating and on time ensures the user is on the same page throughout their trip.

User Training And Support

Training and support materials to help users comprehend and efficiently use artificial intelligence-enhanced calculators. Get feedback from the users to ensure continuous improvements. Additionally, adjust the settings as per the feedback to boost performance.

Review And Continuous Improvement

Continuously evaluate the effectiveness and impact of AI integration. Adjust and improve in response to new information, user feedback, and changing financial landscapes. The success of integrating AI for banking and financial calculators is contingent on the combination of the latest technologies, innovations in financial technology, expert knowledge of the market, a user-centred design, and adherence to legal requirements.

Conclusion

In this blog, we have discussed in detail what the financial calculator does and the cost of finance and banking calculator app development. In addition, many aspects must be considered, including the difficulties that arise during the development process, properly integrating various algorithms in the AI, and integrating it into an existing or newly developed technology. The most important thing to consider is the development procedure that must be followed. All these aspects can be accomplished with the assistance of a solid team. Hiring a professional team for AI-powered calculators and custom fintech software development will require a specific process, for example, choosing multiple firms and choosing one that is compatible with your preferences. If you’re still in a bind, don’t worry. We’re here to help you with your questions. Contact our experts and find the most suitable solution for your company.

Looking to Develop Al Powered Financial Calculator?

Pooja Upadhyay

Director Of People Operations & Client Relations