Technology constantly evolves, and the finance world changes continuously to adapt to new developments. One of the most thrilling changes in the last few years has been the rapid growth in the use of artificial intelligence (AI) within finance technology. AI is already changing how companies in different industries function. Now it’s the right time for the financial sector to join the advancements in finance with AI solutions.

The industry of financial services is extensive and complicated. It covers the entire spectrum of banking services, from retail to investment management to accounting and insurance. Because of its broad dimension, AI in fintech software development could improve efficiency and lower costs in various ways.

AI enhances the fintech industry and changes it by introducing new technologies to develop financial software. Automating complicated processes and providing personalized financial guidance, the impact of AI can be far-reaching. AI plays a more critical role in developing financial software.

Continue reading this blog till the end to learn more about the role of AI in developing financial software.

The Role Of AI In Custom Fintech Software Development

Artificial intelligence and machine learning are two key components of developing and managing financial software. AI algorithms can gather and analyze large quantities of data, analyze trends, forecast, and suggest solutions. Additionally, they are able to make insightful decisions and present them in a simple-to-understand manner.

Finance-related operations like banking and credit offerings benefit significantly from using AI when processing information. Furthermore, many activities in the finance and banking industry, such as asset management or personal finance, can be substantially improved with the help of AI.

Benefits Of Choosing AI For Fintech Software Development

Fintech firms are embracing artificial intelligence (AI) for various reasons. Below are a few specific reasons to use artificial intelligence for financial software development.

Data Analysis & Decision Making

AI assists in shifting large quantities of data much more swiftly and quickly than a human. This is crucial as fintech companies typically have to make decisions based on continuously changing information.

Enhanced Customer Experience

AI aids fintech companies in tailoring their service to each customer by considering each client’s specific requirements and preferences. Therefore, fintech businesses are able to provide a more personalized experience, which will result in customer satisfaction and loyalty.

Gain Competitive Edge

The role of AI in the fintech industry will help you stay ahead of competitors. With more and more businesses entering the financial technology industry, those utilizing AI to gain an advantage are more likely to be successful over the long term.

Fraud Detection & Security

AI algorithms assist in identifying patterns of fraud in real-time. This improves security and decreases the risk of financial loss. Machine learning models and AI analyze large amounts of data to detect irregularities and flag suspicious transactions.

The Ability To Offer New Services

AI helps financial institutions develop new services, products, and solutions for clients. For example, AI has helped banks build Robo-advisory solutions that use algorithms to assist clients in managing their finances.

Lower Costs

AI-powered custom fintech software development can cut expenses, including automating repetitive tasks and detecting and preventing fraud. In particular, banks employ chatbots powered by AI to answer customer questions. This allows human workers to concentrate on other tasks that require more effort.

Enhancing The Experience Of Clients

Financial institutions employ AI to boost the user experience in various ways. These include customizing financial services according to the individual’s needs, providing automatic advice and suggestions, or using chatbots that communicate with clients via voice or text.

Looking for Customized Software Development Solutions for your Business?

Pooja Upadhyay

Director Of People Operations & Client Relations

Scalability & Innovation

AI enhances innovation by allowing fintech companies to develop quickly and implement new products and services. With AI-driven insight, businesses can remain ahead of their competitors and adapt to changing market requirements.

Financial Planning And Analysis

AI can help financial institutions boost efficiency and focus on high-value tasks by automating routine and low-value tasks. It can also detect risks and opportunities to make smarter investment decisions and give personalized recommendations.

Improved Operational Efficiency

The finance industry has rapidly adopted AI technology to increase the efficiency of its operations. AI helps identify mistakes within financial records, accelerate loan approval, and streamline customer support tasks. Financial institutions also use AI to identify fraudulent activities and safeguard against money laundering.

Increased Sales & Revenues

It’s responsible for governing and managing the flow of cash as well as investment. It provides essential services for both individuals and businesses. Financial services are constantly developing and innovating to stay ahead of competitors and keep up with the changing requirements of their customers.

Automated Code Generation

AI-driven programs automatically write codes based on predetermined specifications and parameters. This speeds up development and reduces the chance of human error, ensuring that the financial management software developed will be reliable and efficient. Automated code generation can be useful in repetitive tasks and boilerplate code. It allows designers to work on more difficult challenges.

Personalized Banking Services

AI analyses users’ data, including spending habits, income, and financial goals. AI then provides customized banking services and advice. The advice could include budgeting strategies to suggest investment strategies that increase customer satisfaction and involvement. Personalized services can help bankers and other financial establishments develop solid customer relationships, increasing retention and loyalty.

Fraud Detection and Security

AI fintech software development can identify patterns that might be a sign of fraudulent activity. Based on historical fraudulent data, the systems become better at spotting even the slightest hint of fraud quickly. This improves the security of transactions and protects personal information against unauthorized access.

Credit Risk Assessment

AI models analyze huge amounts of information to determine the creditworthiness of potential borrowers using greater precision than traditional techniques. AI can predict problems with defaults by looking at previous transactions, patterns of spending, and social media activity, which allows financial institutions to make better lending decisions. This lowers the chance of bad debt and also allows for a competitive rate for those with lower risk.

Regulatory Compliance Monitoring

AI instruments continuously monitor regulatory regulations for changes and then automatically modify the systems to comply with new rules. This preventative approach lowers the chance of a violation, which could result in hefty penalties and reputational harm. Automated compliance monitoring helps ensure financial institutions comply with current regulations without any manual supervision.

Automated Customer Support

By using AI-powered chatbots and virtual assistants, banks provide 24/7 customer support, dealing with inquiries and resolving problems faster than is feasible. AI-powered AI devices can recognize and interpret natural languages. They offer accurate answers, complete tasks like transactions or account management, and improve the overall efficiency of customer service.

Algorithmic Trading

Analyzing market conditions, past data, and current information, AI algorithms can execute trades with the best timing to make the most profit. Automated trading processes market information at unattainable speeds for human traders by identifying selling or buying opportunities based on predetermined parameters and executing trades in milliseconds.

Automated Testing

AI helps improve software testing by automating tests, identifying bugs, and suggesting solutions. It can reduce the time and money required to ensure quality and that financial software is secure and safe before its launch. Automated testing utilizing AI will also be able to adjust and adapt to previous testing sessions, enhancing test coverage and efficiency as time passes.

Trading Strategies Development

AI analyzes vast quantities of market data to create and improve trading strategies that aid traders and financial institutions in informed decision-making. Strategies can be adapted to changes in data and learn from market trends and their results for optimal trades in the future. A dynamic strategy development approach could lead to greater returns and lower risk.

Investment Portfolio Management

To improve investment portfolios, AI-driven portfolio management solutions examine market data, risk preferences, and investment objectives. They automatically balance portfolios to respond to market fluctuations and ensure that the investment goals are met in a way that is consistent with the risk tolerance level.

Security Threat Detection

Advanced AI systems scan the networks in real-time, immediately alerting security threats. They can detect unusual behavior that may indicate an attack from cyberspace, like attacks on data or malware, and can take preventative measures to minimize risks. Real-time monitoring and reaction capability are vital to safeguarding customer data and financial information security in a rapidly changing digital environment.

How Is AI Helping Fintech Software Developers?

Introducing artificial intelligence (AI) into fintech solutions represents an evolution towards enhancing the abilities of humans who develop software. AI aims to replace humans and increase effectiveness, efficiency, and decision-making capabilities.

Better Efficiency

AI can automate repetitive tasks, speed up code creation, and improve workflows, allowing developers to concentrate on more valuable tasks and reduce development costs and time.

Enhanced Creativity

While tackling routine tasks, AI allows developers to unleash their creative energy into solving complicated problems and exploring new ways to develop financial software. This fosters a culture of ingenuity within development teams that can lead to more solid and creative solutions.

Optimized Resource Allocation

AI-driven information helps developers better allocate resources in the development of financial software by identifying areas with the most potential for improvement.

Improved Accuracy

AI algorithms can analyze huge quantities of data accurately and precisely. This reduces the risk of mistakes in the development of financial software and guarantees the security and reliability of the product.

Continuous Learning And Improvement

AI models take advantage of past experiences and feedback. Therefore, they can continuously increase their effectiveness and offer designers useful insights that can enhance and improve financial software.

Adaptability To Market Dynamics

AI-powered analytics analyze market trends and user behavior in real-time. This allows developers to adjust the software for financial use to market conditions rapidly to ensure its effectiveness.

Continuous Integration Of Technologies

AI facilitates the seamless integration of different technologies, including machine learning, natural language processing, and predictive analytics, into financial software development.

Market Sentiment Analysis

In analyzing news stories, social media content, and financial reports, AI can gauge the market’s mood towards specific sectors, stocks, and the market overall. It can aid in making investment decisions by providing information about market trends in light of public opinion and the trends.

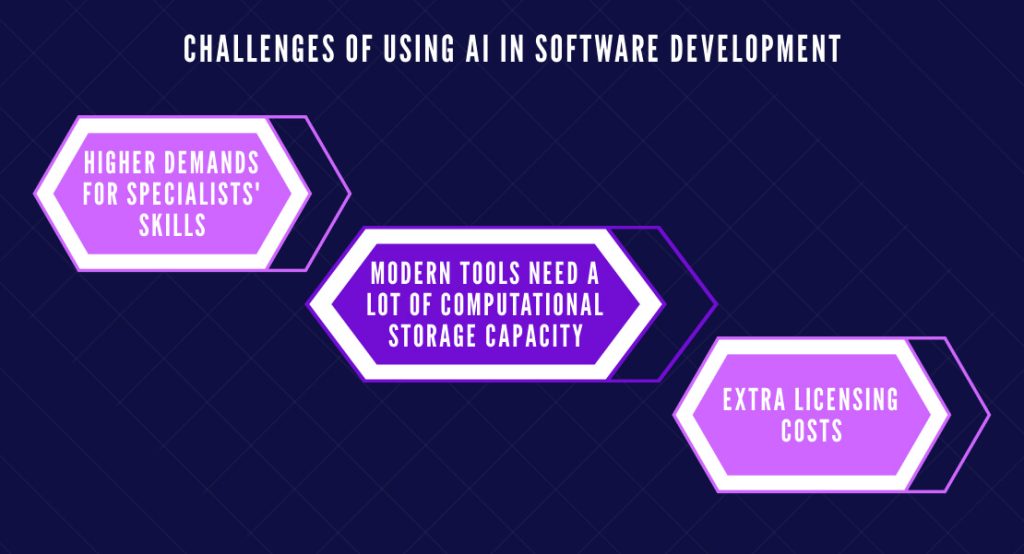

Challenges Of Using AI In Software Development

Using AI in financial software development offers so many benefits but it also brings some challenges that every fintech software development company should know.

Higher Demands For Specialists’ Skills

AI is an advanced instrument that can perform a variety of tasks. To fully benefit from its capabilities, it needs to be managed by an expert with the right skills and knowledge. One of the most essential requirements is the capability to define all input parameters at the highest level of precision. The user should be clear about what they intend to accomplish and then describe the specific goal.

Modern Tools Need a Lot Of Computational Storage Capacity

A company that develops software heavily relies on AI technology must invest in top-quality equipment. More powerful equipment generally implies that AI can complete its job more quickly. This will speed up the development team’s activities and cut down the time it takes to launch the product.

Extra Licensing Costs

Professional tools can be expensive, especially when it comes to software development. Modern AI and ML solutions are expensive for commercial usage. However, the costs are affordable and justifiable. Artificial Intelligence-enhanced technology quickly pays its way, mainly when highly skilled software engineers utilize it.

Future Prospects Of AI In Financial Software Development

The possibilities of AI in financial software advancement point to the future of technology that enhances financial services. It also opens possibilities for innovations and effectiveness. What can we expect for the next few years:

Focus On Deep Learning

Deep learning is set to center the stage of AI advancements in FinTech. It will enable more sophisticated and data-driven decisions. The focus on deep learning will allow banks to gain information from massive datasets at an unprecedented scale. This will lead to a more personalized and effective product.

Improvement Of Natural Language Processing (NLP)

NLP technologies are expected to improve, allowing AI technology to recognize and process human conversation better and more efficiently. This will enhance customer service robots, making them more nimble and able to handle Complex Questions And Customer Transactions Seamlessly.

More Accurate Predictive Analysis

Thanks to the development of predictive AI algorithms, the analysis of financial software development will be more precise. This will allow institutions to anticipate market trends, credit risk, and consumer behaviors with greater accuracy. This ability will help improve risk management and provide an advantage in competitive market and investment strategy analysis.

Evolving AI Technologies

The forecast was that enhanced deep learning, reinforcement learning, and the emergence of explicable AI (XAI) can keep improving the utility of AI for financial software. They will increase efficiency and effectiveness by helping manage and control important choices, personalization, and interaction aspects with the user in many ways.

Market Trends

The need for AI-integrated custom fintech software development will likely increase as more companies converge on the latest technologies. Many of the most efficient mobile app development firms operating in Delhi and the other major tech cities are actively pursuing this market trend and have invested in building their AI capacity.

Further Automation Of Financial Services

Automatization is a key component of FinTech, and it is expected to extend beyond simple operations to more intricate financial processes, such as customized Financial planning and robo-advisory that automate underwriting and claim processing. This change will increase the efficiency of operations and provide consumers with better-tailored and flexible Financial products.

Collaboration In Conjunction With Blockchain Technology

Incorporating AI in blockchain technology will enhance the blockchain’s capability to secure and transparent records and transactions using AI’s power of analysis. Blockchain has revolutionized the financial and banking industry with its fast and reliable transaction platform.

In addition, AI enhances these processes through smart contract automation, fraud detection, and service improvements. Using blockchain as part of the authorization and authentication processes improves security by guaranteeing that financial transactions and access to sensitive information are safe and efficient.

Summary

AI’s influence on financial software growth is huge. AI has revolutionized our investment and banking by making processes more efficient, increasing security, and providing customized experiences. The integration promotes innovation and makes financial services more accessible. By integrating AI into financial software development, businesses can get an edge in competition, enhance decision-making performance, and improve customer satisfaction.

AI-driven software is driving efficiency and innovation. It offers customized solutions that enhance security measures and optimize investment strategy. As we look ahead, this harmonious partnership will continue to define the world of finance and create flexibility, inclusiveness, and improved performance across the entire industry. At its core, AI plays an integral part in helping financial institutions remain at the cutting-edge of an increasingly volatile marketplace.

AddWeb Solution can help you build enterprise-grade custom financial planning software to cater to all your business needs.

Pooja Upadhyay

Director Of People Operations & Client Relations