Artificial intelligence (AI) is quickly advancing within today’s business environment. It is now incorporated into products and programs that companies employ every day. AI-powered lending platforms use machine learning (ML) algorithms to analyze massive amounts of non-financial and financial data to determine borrowers’ creditworthiness and make quicker and more precise loan decisions. With the number of technology and software companies claiming AI capabilities, it was just an issue of time before AI was introduced to the world of financial statements.

AI-based lending software development services are revolutionizing lending and management in the current technological world. The approval of loans that took a long time was cut to 60 seconds and with the most excellent quality. To analyze the borrowing patterns, banks utilize Artificial intelligence, machine learning, and natural process of speech (NLP)to reduce the chance of being unable to pay. They are better equipped to identify bank fraud due to this approach, which is based on data and reduces the need for intuition to make decisions.

In this blog, we’ll explore what AI lending platforms are, their benefits, challenges, and use cases in detail.

What Is An AI-Powered Lending Platform?

AI lending platforms are an incredible force within the world of finance, transforming how loans are accepted and processed. A digital lending platform allows mortgage and home buyer customers to connect with a lender using only digital channels, including your smartphone, desktop application, or even a web-based site. It could use artificial intelligence (AI) to streamline the customer experience, add individualization, and accelerate processing decisions on the endpoint.

A digital lending system that the user can access should be backed by a strong mortgage technology platform that can automate the entire process. Starting with wholesale and customer engagement and moving on to sales, origination titles, servicing, and origination. These components together give lenders the capability to handle many requests, cut down on sub writing efforts, lower risks, and ensure conformity.

Benefits Of AI-Driven Custom Lending Software Development

Artificial intelligence development is profoundly affecting the world of lending. AI-powered lending platforms employ machine learning algorithms to analyze large volumes of financial and non-financial information. This is done to evaluate customers’ creditworthiness and make quicker and more precise lending decisions.

Personalized Product Recommendations For Loan Platforms

Both service and product providers widely utilize AI to provide targeted marketing. The provider can focus on customers based on the specific demographic information and their mood, ensuring a high probability of converting. Digital lending platforms utilize AI similarly to upsell or cross-sell the loan product and service.

In this case, for instance, an AI engine can detect modifications in a user’s behavior and information about their account, like when they are offered new jobs or relocate to another city. The system can automatically recommend mortgage options based on the customer’s intelligence.

Reduce The Chance Of Errors

Scoring credit scores for customers is a labor-intensive procedure that requires lenders to comb through numerous documents, information sets, and risk factors to determine a person’s creditworthiness. Most of the time, the last decision to score risk comes directly from human judgment that isn’t just susceptible to error and non-compliance.

Custom lending software development uses an AI engine to analyze numerous data elements related to a person’s financial background, including tax filings, transaction patterns, rental history, and more. This provides a broader credit score that does not depend on one decision-making point.

AI Bots To Provide Lag-Free Service To Customers

Digital lending platforms powered by AI bots could simplify many service-related communications. When customers send questions or ask for information, the machine can scan through large amounts of data stored in complicated databases within moments.

It uses natural language understanding to translate the request into machine-readable format. Based on the inputs, it collects information. It transforms the data to English via natural translation (NLG) to reply to the user.

Increased Access to Credit

AI will likely expand the number of people who have access to credit since AI-powered lending platforms can evaluate creditworthiness using more diverse data, including non-financial ones like social media usage and spending patterns. This helps make credit accessible to those with weak or no credit history and those typically excluded from traditional lending institutions.

Faster And More Efficient Lending Process

AI-based custom lending software development could automate many aspects of the lending process. It can assist lenders in speeding up approval and also provide customers with a quicker and more effective experience. In particular, AI-powered loan platforms can approve borrowers’ loans in just a few minutes.

AI Manages Loan Documents To Improve The Experience

Document management is among the main areas in which AI could play an important role. End-user systems can be fitted by an AI scanner software that transforms photographs of physical documents into formatted PDFs. A lender may use optical character recognition (OCR) to instantly collect information from photos and screenshots, but without having to depend on a human employee to input data.

AI can automatically sort documents, index them per regulatory guidelines, convert document formats to keep the standardization process, and so on. This can improve the experience of your employees as well as for the person who borrows.

Financial Institutions Can Improve Their Cash Flow

Companies require speed and convenience, which is only sometimes possible when using traditional loans. Companies with urgent cash requirements can quickly join and get finance before it’s too late. Positively, firms can benefit from the hot market. They can quickly finance inventory or employ new workers to meet growing demands.

This is fantastic news for all of us. It is not ideal for lenders to be viewed as the ambulance on the other side of the mountain, acting when companies stand at the edge of destruction. Finance should be used as a growth instrument, not a parachute.

Small And Medium-Sized Businesses Have Access To New Finance

As financing is time-consuming and bureaucratic, small companies are often not considered. The reason is either that it’s not economically viable for lenders to accept their clients or the duration is too long, and the SMB cannot afford the wait. Automation and AI-based loans ease this burden, meaning SMBs have the same benefits as everybody else’s customers.

More Platforms Can Incorporate Lending

We’re big advocates of lending-as-a-service (Laas) platforms. They allow any platform to incorporate lending in their products without creating an entire lending platform they own. Although LaaS integrations were available before the current AI explosion, the advancement of technology allows for more accessible and less costly integration into existing products. Since lending gets cheaper and the administrative burden is reduced, many more lending applications will be in the tech industry.

Empower Your Business with Custom Lending Solutions – Let’s Build Your Software Together!

Pooja Upadhyay

Director Of People Operations & Client Relations

Lenders Provide Services To More Clients

In the reverse situation, lenders are incentivized to service a greater spectrum of customers, such as these SMBs. Administrative costs drop, which means that even customers with a lower chance of profit can still be successful. It is also possible to explore more strict compliance-oriented businesses and sectors. If you thought the KYC procedure was once tedious and time-consuming, it’s not an issue if you think it’s now worthwhile.

Fintech Has the Potential To Grow With Lower Expenses

Additionally, AI lending platforms are integrated into the larger financial market. Start-ups don’t exist solely to take over the banks and lending institutions. We’re looking to incorporate and offer the resources they need to perform their crucial part in the economic system.

Of course, this has substantial positive effects for fintech development. It is possible to grow with these partnerships without spending too much on go-to-market strategies. Suppose we keep sales, marketing, and operating expenses at a minimum. In that case, we can concentrate on what we excel at: developing the latest generation of lending technology.

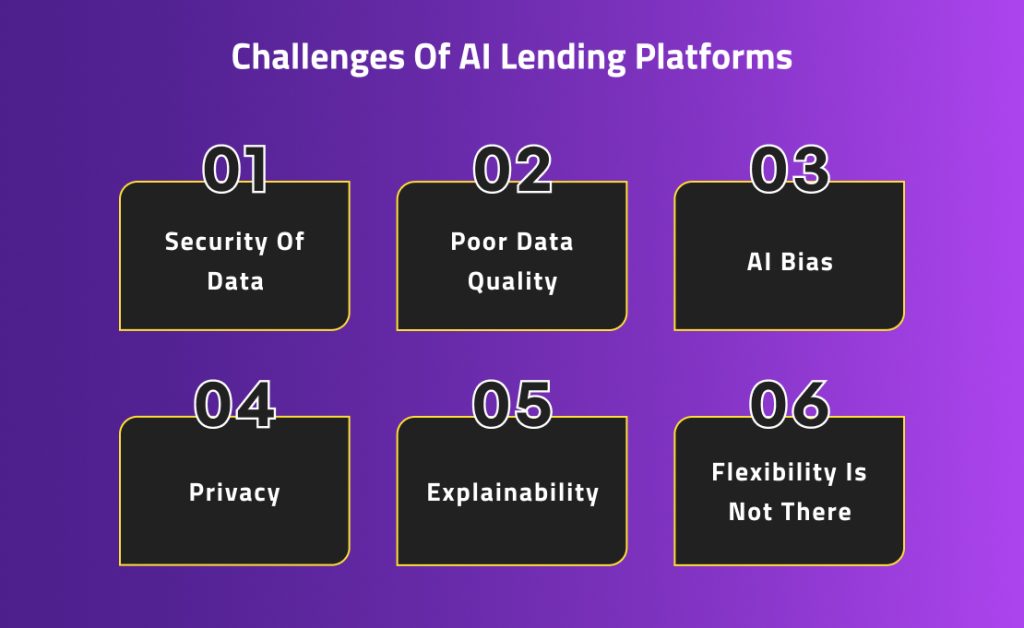

Challenges Of AI Lending Platforms

We know that AI lending platforms are efficient. Data leaks can be a significant problem for people who disclose sensitive financial information. In the case of organizations that use AI lending, any data breach from users could leave them vulnerable to legal action and reputational damages.

We will look at some of the biggest problems banks face using artificial intelligence to improve their processes.

Security Of Data

Data algorithms must be able to access sensitive financial information to forecast trends and analyze risk in credit. Whichever software you use to automate loan administration, comply with the GDPR, SOC-2, CCPA, and local regulatory standards.

Poor Data Quality

It is about how this peer-to-peer lending app development and AI obtained the information it needs to learn and make choices. AI models such as ChatGPT require large quantities of high-quality data for training. Lack of or inaccurate data could lead to incorrect or untrue results.

AI Bias

AI biases are a common issue acknowledged as a source of concern for tools for analyzing loans. A class action lawsuit claimed the refinancing calculator discriminates against minorities and female mortgage applicants because it has to be accompanied by a ZIP code, a degree, and an area code. Using AI devices that have not had a thorough test for bias may put your company in danger of being sued for breaching fair lending regulations.

Privacy

Data from financial transactions is typically delicate, so raising privacy issues when used for training an AI model. Banks must be able to guarantee that their information is secure and avoid incidents, in addition to protecting their privacy and ensuring the trust of their customers.

Explainability

Explainability, which is the need to explain to consumers why they have been denied credit, can help customers understand ways to enhance their credit chances. However, it also holds banks accountable for their choices and helps provide evidence of discrimination. Based on the AI lending platform, explaining can be more complex, and banks might require assistance in understanding why the algorithm came up with the results it could have.

Flexibility Is Not There

One of the biggest problems with small-scale lending, regardless of whether they use AI or the traditional method, is the fact that owners of small businesses generally need to employ conventional accounting procedures. The financial statements can include taxes, financial statements, and company finances that connect to different entities. A fully automated system to take care of the lender’s decision-making typically isn’t an ideal choice for community banks or credit unions because of the same reasons and others.

Although the efficiency and time savings advantages from the use of AI for lending might seem attractive, the additional pressure upon vendor management to validate the model- a requirement that is ongoing when the model is constantly adding new information and changing its assumptions – may limit the gains that could be realized. With the potential of spending days or even weeks in an audit or examination, defending and reviewing the algorithm’s decision-making process, the company is likely to spend longer if it employs programs that rely on AI for decision-making.

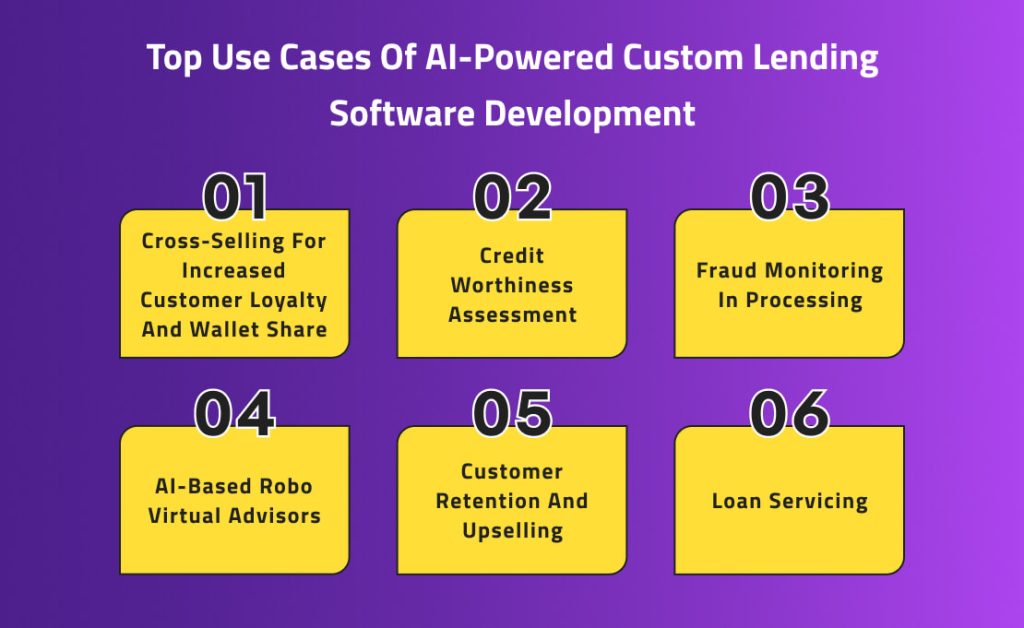

Top Use Cases Of AI-Powered Custom Lending Software Development

The effect of AI technology is evident more than ever in our everyday lives. From prompts for quick translation to interactive interfaces that can be used for conversation, AI can profoundly impact changing the entire capabilities stack. The result is a fundamental change in technology and data infrastructures, which adds an engaging layer and speeds up decision-making. To better understand, we will look at some usage cases of lending software development services driven by AI.

Cross-Selling For Increased Customer Loyalty And Wallet Share

Today, customers are seeking customized services. This undoubtedly impacts customer satisfaction and loyalty. In the age of personalized, curated services, data mining is crucial. AI-powered tools are assisting financial institutions and banks in accessing a massive amount of customer information and analyzing it to determine patterns in customer behavior.

Services that are more attentive to customer needs result in more customer response and involvement. A growing amount of customer data usage and the increased power of computers to analyze it leads to more accurate and dynamic insights that allow customer-centric decision-making. Digital channels allow businesses to improve their marketing strategies by analyzing these data, enhancing customer satisfaction, and generating more important cross-selling opportunities.

Today, customers depend on many providers for the same service. If understood correctly, customers’ behavior will aid businesses in gathering a large amount of data. Sharing wallets could go a step ahead to help with customer retention. Artificial intelligence and automation intervene to streamline the process by analyzing data intelligently.

Credit Worthiness Assessment

Commercial lending relies heavily on the credit score of clients. Commercial lenders or banks are not able to and do not offer loans to those who do not have good credit scores. Moving away from traditional modern lenders, they are shifting towards automatic credit decision-making technology. Different scoring models are put in place to assess the creditworthiness of borrowers and provide loan conditions. The process of measuring the credit score and then giving the loan to the customer is seamless, thanks to AI-based credit scoring.

The customer’s credit score is compiled and then evaluated against a benchmark. Customers’ eligibility is checked using the bureau’s information. A maximum of 3 credit offers will be displayed to eligible customers. Credit cards and loans are issued once a customer completes an automated KYC and onboarding the digital client, which is difficult to accomplish manually.

AI integration allows time efficiency and faster evaluation and loan disbursement. It could be among the numerous AI integration models. The modern consumer expects a speedier process for credit evaluation and disbursement. Rapid innovation and investment occur in commercial lending, serving customers at the perfect time.

Fraud Monitoring In Processing

AI and blockchain technologies speed up and protect identity verification for loan applicants. Smart contracts can control and monitor loans throughout their life. They can reduce non-payment risk and report delays and unreported loans. AI allows solutions developed by custom lending software development company to integrate document history and authentication of financial data and information. Consensus and shared access ensure the limitation of fraud, efficient governance, and transparency of the underwriting process.

As companies and banks move towards “AI-first,” a sustainable, strong, and robust technological backbone has to be established. Weak security and fraud are major threats to developing technological advances overnight, making any information susceptible. Thus, a thorough security test is a requirement before new technologies become available and accessible to the public for their benefit.

AI-Based Robo Virtual Advisors

One of the significant developments that AI has brought about is AI Robo-Advisors, which are developing solutions that could help complex procedures. The Robo-advisors can assist customers through financial or support advice. They could provide which loan is the most suitable and set reminders. The system could offer complete customer support to build a sound financial plan for clients.

The algorithms are intelligent and perform a range of roles. When coupled with the technology stack, they could aid in making decisions. With no human interference, they can respond to simple customer queries, thus reducing pressure on contact centers.

Customer Retention And Upselling

The rigors of data integration and data analytics on user behavior drive AI-powered lending institutions to discover and develop upsell opportunities for customers. Implementation and integration are dependent on the amount of time. To stand out from the rest, opportunities to upsell allow you to keep clients.

Modern AI technology has revolutionized the interactions between banks and customers. The benefits are reduced costs, access to data, more storage, and connection. This technology allows banks to provide customers with an experience-based banking service that increases revenues and opens up new possibilities.

Loan Servicing

AI-powered tools efficiently deal with the servicing of loans. They are the first contact point between clients and lenders. Interactive AI chatbots help in addressing customer concerns quickly. They can issue monthly reports and EMI collection and maintain archives of advanced payments and withdrawals. AI can design end-to-end solutions for recording customers’ demands for tax collection and insurance payouts and sending the money to the note-holder, noting any outstanding balances.

Conclusion

The development of AI lending platforms has enormously impacted the lending sector, transforming the finance landscape. The technology has made credit available and effective for borrowers and helps lenders manage risk. The use of machine learning and AI to manage loans appears promising. AI technology will sooner or later be able to take over the commercial and banking lending market.

Introducing AI lending platforms would help improve banking experiences for customers worldwide. In addition, banks will need to enhance their home-grown models by adding modern capabilities to make significant changes towards an ideal customer experience.

Streamline your Loan Management with Our Bespoke Lending Software solutions!

Pooja Upadhyay

Director Of People Operations & Client Relations