The technological world has forced us to rely on mobile devices, so we purchase almost everything online and even services on demand. Apps like these have simplified our lives and helped us organize our working methods, making them more organized and transactions faster. Like other apps that have facilitated many things in our lives, lending apps for loans also aid those needing the loan they want.

There are many options to lend money today in the digital age. However, the growth of loan applications is most likely. The ease with which peer-to-peer lending app development allows anybody to get a loan makes life simpler for all.

The groundbreaking business model of loan lending applications focuses on fast cash lending with no lengthy documentation. Businesses and their customers enthusiastically adopt this revolutionary business method for all the proper motives. In addition to borrowers not making frequent bank trips, lenders are more suited to keep records and collect payments using an automated system.

If you’re considering what you can do to develop an app for a loan, this blog can help you learn about loan lending mobile app development, from its innovative features to the cost.

What Is a Loan Lending Mobile App?

Loan lending applications are a community platform on which the money lender and loan seeker can meet one another’s requirements. Peer-to-peer lending applications for loans have been growing rapidly each year. They always give applicants access to loan options and do not require users to go to an institution like a lending center or bank. The loan lending apps are ideal for those who can’t stop by a local bank to fill out the loan application.

The lenders and borrowers of capital have to utilize the application. It also needs infrastructure and workers. Thanks to the apps, the process of lending loans is simple. All you need is for both parties to agree on the same terms before the loan applicants can get their funds.

The loan lending software is an excellent method to increase your profits, regardless of whether you are a start-up or a traditional brick-and-mortar banking institution. The software will allow your company to communicate with customers through various methods. However, it is possible that not having a credit application can lead the company to miss crucial business opportunities that could affect the brand’s reputation and expansion.

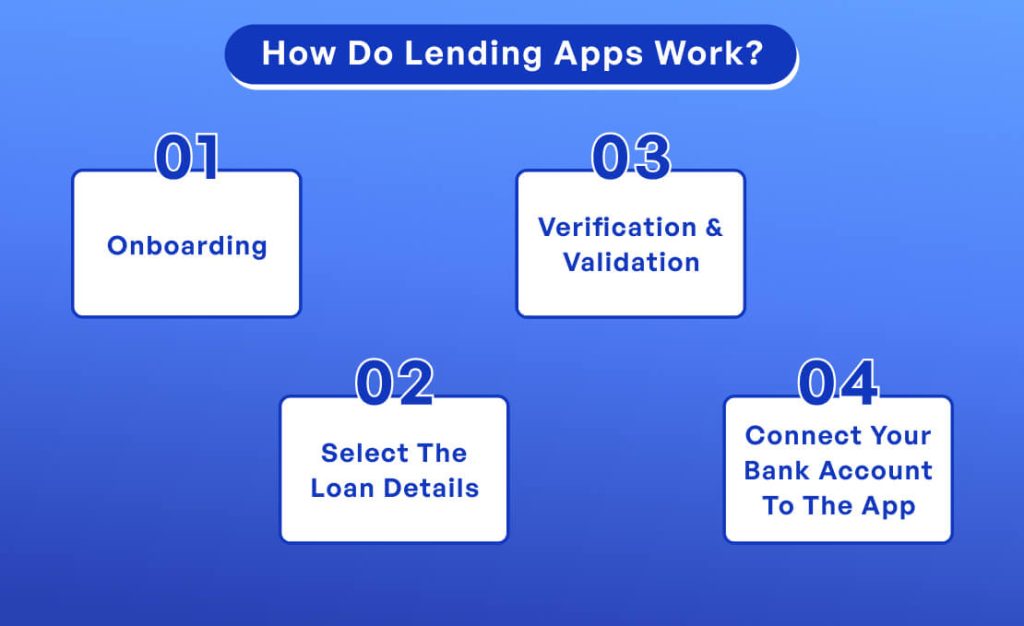

How Do Lending Apps Work?

It is very easy to operate loan apps. The app development companies integrate various features into the loan lending mobile app development.

Onboarding

After you have downloaded the app for lending on your device through the app store and launched it, you’ll be on the application’s main page. The first step (app users navigating this webpage) is to sign up using this link. After that, you’ll be able to register as an account. First, fill in certain information like your name, phone number, email, and social handles. Once you’ve done that, you can sign with your credentials to explore the application.

Select The Loan Details

An alternative screen will appear that allows you to take out loans. On this screen, you’ll be able to review the different loan categories this app offers. Pick the loan category that you like. After that, you’ll need to add your interest rate to the amount you’d prefer to get. Choose the best option. Set the time frame for when you can repay the loan.

Verification & Validation

It is the process that will determine your creditworthiness for the loan, as well as your credit score and other financial data. You will be taken to a page where you can enter information like address, education, job history, and income details.

Connect Your Bank Account To The App

Connect your bank account with the mobile app to ensure that the loan balance is immediately transferred to your account. The app will inform the bank of your transfer. Similar to the payment of the loan, a set amount will be deducted from your bank account as the due date is near.

Are You Looking to Develop a Loan Lending Mobile App?

Pooja Upadhyay

Director Of People Operations & Client Relations

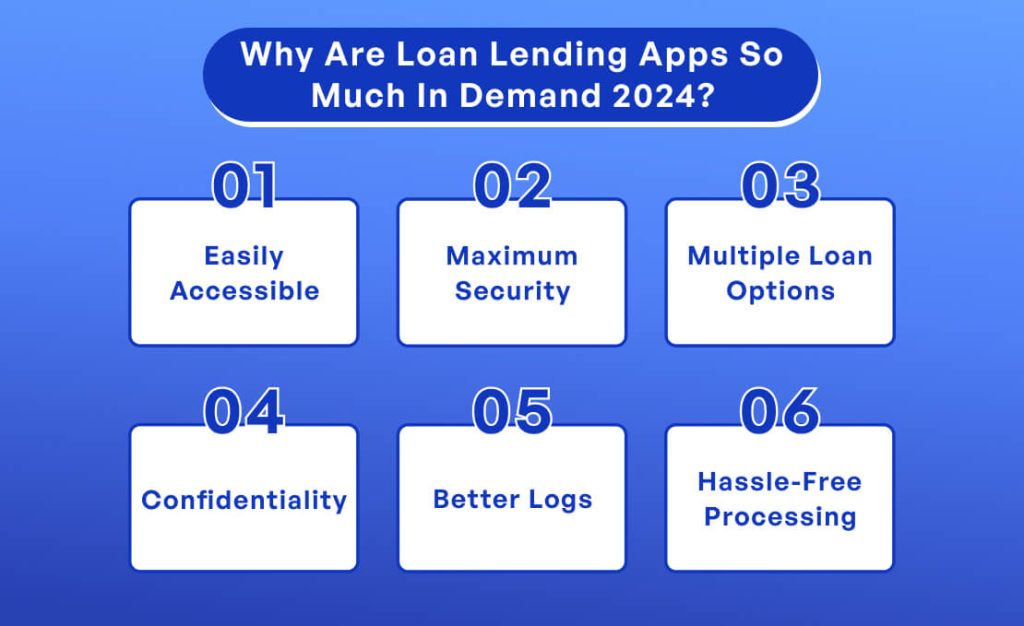

Why Are Loan Lending Mobile App Development So Much In Demand 2024?

One of the best features of mobile applications is that they’re available 24/7. Loan lending software development services or apps are a bank inside your pocket. Through the loan lending app, they are quick, easy, and ever-present to get money or create deposits.

Easily Accessible

Borrowers do not have to go to banks as they do with traditional loan processes. They can do all of this from the comfort of their sofa in the comfort of their home. Additionally, investors can undergo a smooth online investment procedure.

Maximum Security

The loan lending mobile app development is based on a safe, encrypted network that can transmit all client details and financial transactions. Users only have to create the password to their account on the app.

Multiple Loan Options

The loan options that the apps for money lending offer users vary between payday loans and personal loans. Everybody requires a loan for different reasons, and the loan lending app is an excellent solution to this demand.

Confidentiality

Some loan applications cannot be made for homes or new vehicles because specific individuals require money for illegal purposes. The loan lending mobile application is a great way to provide confidentiality and security for this scenario.

Better Logs

The experience of a commercial bank customer comprises transaction data. Similar to automated transaction records, they can be created through mobile lending applications, which makes it easy to view them in the application. Better records management allows customers to pay promptly, which can further be improved with prompt messages and alerts.

Hassle-Free Processing

One of the best benefits of using an online loan application is the ability to invest and loan money at any time without going through lengthy procedures. You can conduct a few background checks, persuade the lenders to accept their loan, and sign a loan agreement. In addition, the borrower may obtain a loan through an investor, undergo the necessary background checks, and receive money straight into the account of their choice.

Benefits Of Loan Lending Mobile App Development

A loan-lending app is sure to remove several obstacles for borrowers. They are so comfortable with this easy option of borrowing cash from their homes that they will be tempted to consider it anytime they require loans from lenders or banks. These apps not only favor customers but also greatly benefit companies and banks. These apps allow users to achieve their goals without going to lenders.

Advantages To Borrowers

Simple Procedure

Borrowers can easily complete an application form to apply for a loan and upload it using the application. The lender will examine the form and then approve it instantly.

Easy Management Of The Loan Applications

You can easily track the status of the loan application process and obtain the decision online, eliminating all visits to banks.

Security

Every transaction made via the platform is secure, and the application encrypts the information. Users can set up a secure password for their account and ensure that it is secure without divulging it to any other person.

History

The app logs all transactions made using the app and all loans made by the borrower. The log can be accessed anytime there’s a reason to.

Multiple Options For Borrowing

Because it’s all online and available on one screen, customers can examine the kinds of loans they qualify for and then compare them to pick the most suitable option.

Accountability

The lenders that have applications are acknowledged by their respective companies and have earned the trust of their borrowers. Suppose you’re unsure of borrowing funds from outside companies on the app. In that case, reading the reviews and reviewing the ratings is always possible before borrowing money from them.

In-App Messaging

Lenders and borrowers can communicate through the platform to discuss loans on the internet. This can help the borrower make better credit decisions.

Lesser Amount Of Paperwork

They require minimal or no paperwork because all paperwork is uploaded online. Users need to submit scanned copies of all the necessary documents during the registration process, which makes it simple for lenders to offer credit.

Advantages To Lenders

Reduces Operating Costs

Loan lenders are not legally required to set up suitable offices or host their customers to reduce operational expenses. They can operate without infrastructure in even the smallest areas.

Many Clients

They allow companies and lenders to service many customers at the same time. A customer doesn’t need to be able to deal only with one lender when he can contact many of them at once.

Rapid KYC Processes

Lenders do not need the borrower to present their documentation in person every day. The apps permit customers to upload their original documents’ scanning copies onto the application, which the lender then downloads.

Maximum Reach

The bank may not be within the accessibility of those living in rural regions. Loan lending applications aid in bridging the gap between lenders and borrowers. They allow the two parties to settle regardless of where they are. of the globe. So, it could be legitimately stated that these applications can be scalable and help users make contact with anyone.

Must-Have Features Of Loan Lending Mobile App Development

Then, your plan transforms into a high-responsive and profitable money lending application that requires the administration of numerous functions that can be integrated into the application. The loan lending mobile app development provides a start-to-end with a single point of contact where customers can provide a simple procedure.

Below are the features that can be added to the loan application.

Chat Support

While lending applications are great because they remove the requirement to interact directly with a representative, customers will likely still require help. In addition, an online chat session with the agents could be an excellent way to deal with these situations.

Easy Loan Calculation

Your app for lending should have the ability to calculate your loan. Please do not leave it up to your app users to figure out the amount of their loans since they’re likely to be novices in the field of loans. Use a calculator in your app to help customers calculate loan-related information.

The customers should understand the most essential information regarding the loans they have made through your application, such as the rate of interest, monthly payments, and any other essential details.

Customization

Through their utilization of capabilities native to the device and their user interface (UI) style, customized mobile applications provide users with the most enjoyable experience. Loan apps that are custom-designed work similarly.

Make sure not to use an unoriginal design. Some top lending platforms have been designed beautifully with an eye for the smallest details. Though it may seem minor, it can significantly affect how your customers perceive your company.

Analytics And Reports

Administrators can access comprehensive reports with detailed analyses that will improve efficiency through custom lending software development. The amount of money taken out over an exact period and the amount returned over the same period is available to administrators.

Paying On Time

The ability to deduct automatic loan EMIs from borrowers’ bank accounts through the setting of this feature. Furthermore, this stops lenders from making all loan repayments.

Records Of Transactions

Customers should be able to monitor any outstanding or completed payments when a loan has been granted. Customers should be able to determine the amount of debt to be paid quickly.

Cloud Storage Integration

Cloud technologies can significantly benefit the app because of the numerous requirements regarding user data privacy. This function can ensure the security and privacy of users’ personal data.

Convenient Payment Plans

Customers can use this vital option to restrict their monthly payments only to the sum they took from the approved loan—the ability to limit their total payments with this feature.

Push Notifications

The feature will work most effectively to provide the most up-to-date information about app activities and the balance of your EMIs. It also helps customers get current discounts and offers from the lender.

Online Support

They have an online help desk that is always available to speak to users and provide details about the loans they have taken. The help desk will instantly notify customers about the latest transaction and remaining loan amount.

Cloud Storage Integrated

Privacy and security of users’ data are crucial, and the app’s administrators have to ensure that they are secure and private. This is only possible through the use of cloud storage within the application.

Analytics

This real-time report helps app developers to understand the efficiency of their applications. The information they gather can aid the app owners in implementing or eliminating specific features based on the demands of their app’s users.

Chatbot

It’s a unified support service that customers can contact at any time to receive answers to their questions. The idea may be similar to human assistance. Still, chatbots are all managed by computers, and the machines can respond to any questions or queries from users.

How Much Does It Cost To Create a Load Lending Mobile App Development?

The loan lending app is developed at a cost ranging from $48,000 to $84,000, depending on the features you want. If you’ve done your homework and have thoroughly evaluated available SDKs, the loan lending mobile app development cost is likely lower. The cost of developing the mobile application for loans is contingent upon several factors. However, the business you choose to build your loan lending app creation impacts the expense, so it is essential to consider these factors.

App Platform

Make the best choice between iOS and Android, as your app platform is complex and directly impacts your financial budget and foundation.

App Design

The appearance of your app should be attractive and compelling enough to draw the user’s focus. This is why you should hire an expert designer to create an app with an interactive user interface (UX). Be aware, however, that this can raise the application’s costs and create more complexity.

App Features

They are a vital part of the program. Additionally, adding basic features will not affect the overall cost; however, advanced features may be added in specific ways. Therefore, make sure you select wisely.

Location & Experience Of The Company

When hiring a custom lending software development company, they must consider their prior experiences before deciding on their cost. Additionally, you should consider whether outsourcing or internal services will affect the price of development.

Conclusion

The apps for loan lending are doing very well these days, and with such apps, there’s a good chance for entrepreneurs to put their funds into it. The latest technologies have created a mind-boggling system of managing loans that is becoming more evident. Suppose you plan to make a Loan Lending application. In that case, you need skilled mobile app designers, developers, project managers, and a full-time team to complete the project successfully. For those planning to obtain a money-lending app designed for your business, you can beat all the others and be a winner over your competition as more and more people move from bank loans to readily available loans using these applications. It would help if you found the right team for loan lending mobile app development, one who can listen to your thoughts and then implement modern technological advances and capabilities into your app.

Boost your Loan Management Services with our LMS solution.

Pooja Upadhyay

Director Of People Operations & Client Relations